extended child tax credit dates

The maximum child tax credit amount will decrease in 2022. The legislation made the existing 2000.

The Child Tax Credit After The Economic Growth And Tax Relief Reconciliation Act Of 2001 Unt Digital Library

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021.

. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. But if Bidens nearly 2 trillion American Families Plan ever gets.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. While the IRS did extend the 2020 and 2021 tax filing dates due to the pandemic you. JOE Biden is calling for expanded child tax credit payments to be extended until 2025 - as millions of families are set to receive their first payments next week.

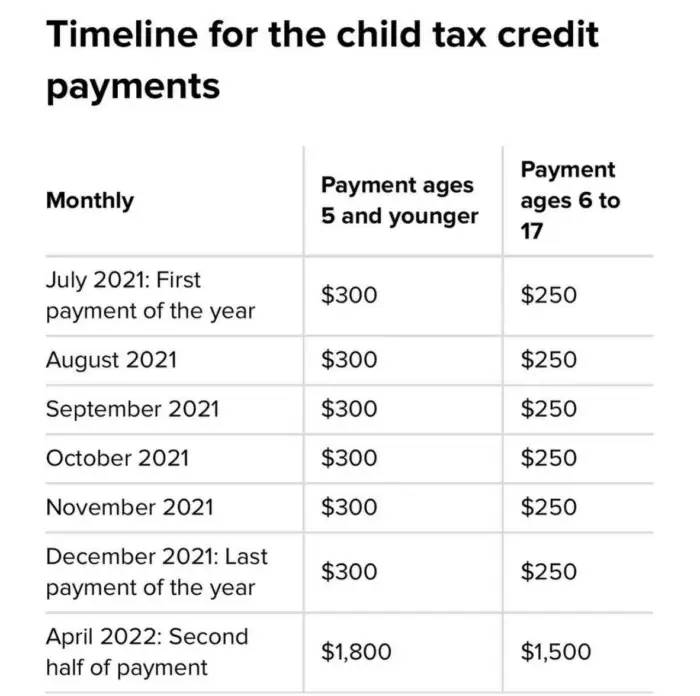

As part of the American Rescue Act signed into law by President Joe Biden in. The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion. The American Rescue Plan expanded the child tax credit for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those 6 through 17.

While the IRS did extend the 2020 and 2021 tax filing dates due to. W ith Novembers payment now out the IRS is down to one payment left this year coming in December. The Child Tax Credit was significantly expanded in 2021 by the American Rescue Plan so families could receive up to 3600 per child under 6 and 3000 for those ages 6 to 17.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. And while for many the checks and direct deposits have arrived on time each. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17.

Here is some important information to understand about this years Child Tax Credit. To reconcile advance payments on. The Child Tax Credit provides money to support American families.

The cost of extending it until 2025 has been. Under the current plan the child tax credit will financially assist eligible parents through the end of this year.

Will The New Child Tax Credit Be Extended Forbes Advisor

Extended Child Tax Credit Archives 19fortyfive

Advance Child Tax Credit Payments Begin July 15

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

2022 Tax Refund How Child Tax Credit Affects Parents Across America Us Patch

Child Tax Credit Irs Warns Final Deadline Is Here For Low Income Khou Com

How The New Child Tax Credit Could Lift Children Out Of Poverty

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Deadline Extended Dominion Disconnections Pause Aerial Spraying Hampton Roads Messenger

Arizona Families Now Getting Monthly Child Tax Credit Payments

Child Tax Credit Nearly Half Of Eligible N J Families Haven T Filed For Benefits As Deadline Looms Nj Com

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

What You Need To Know About The Child Tax Credit The New York Times

Calls To Shore Up Child Tax Credit Long Term In Build Back Better Act News Kmaland Com